XAI100 – Investing in the Global Top 100 AI Innovators

XAI100 – Investing in the Global Top 100 AI Innovators

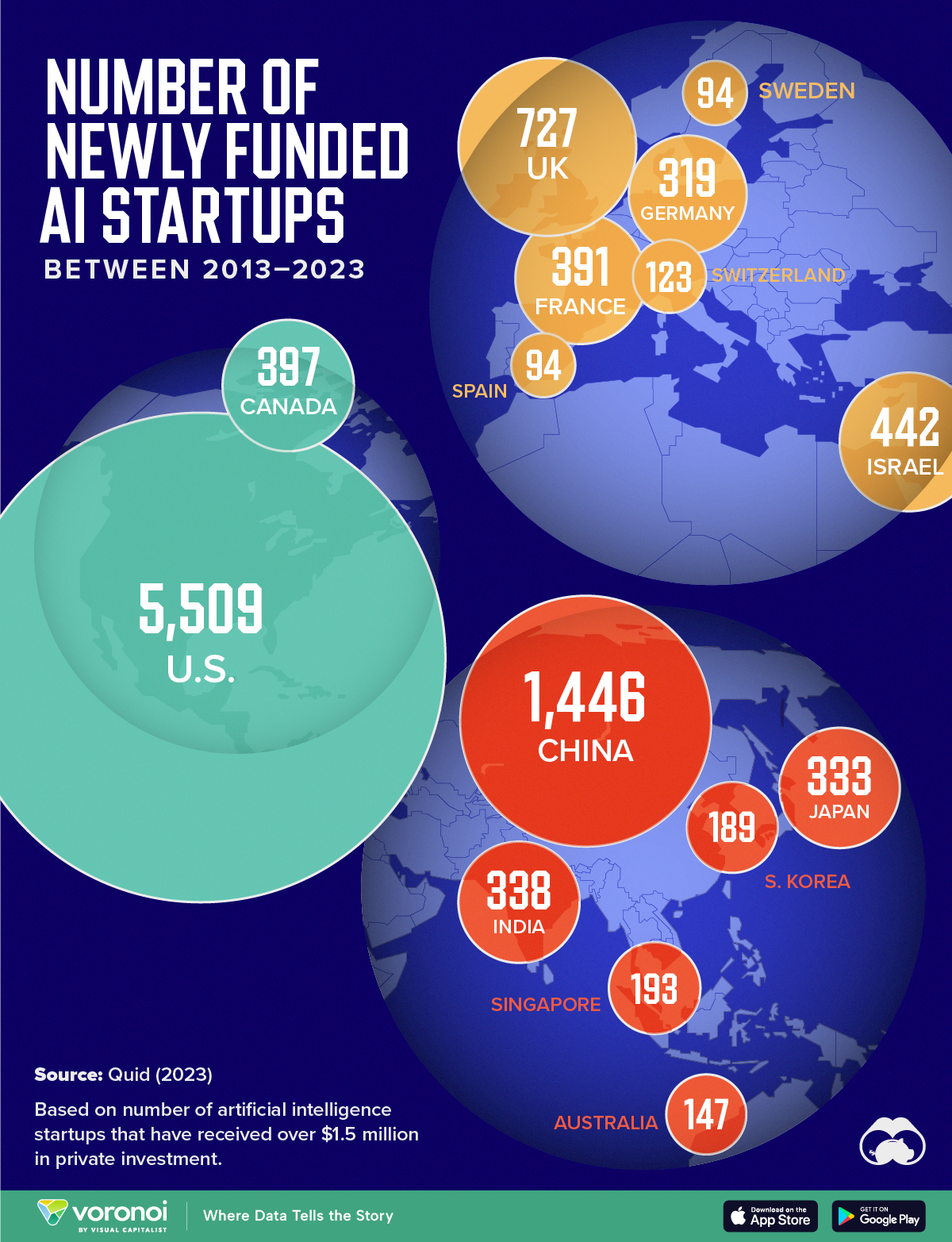

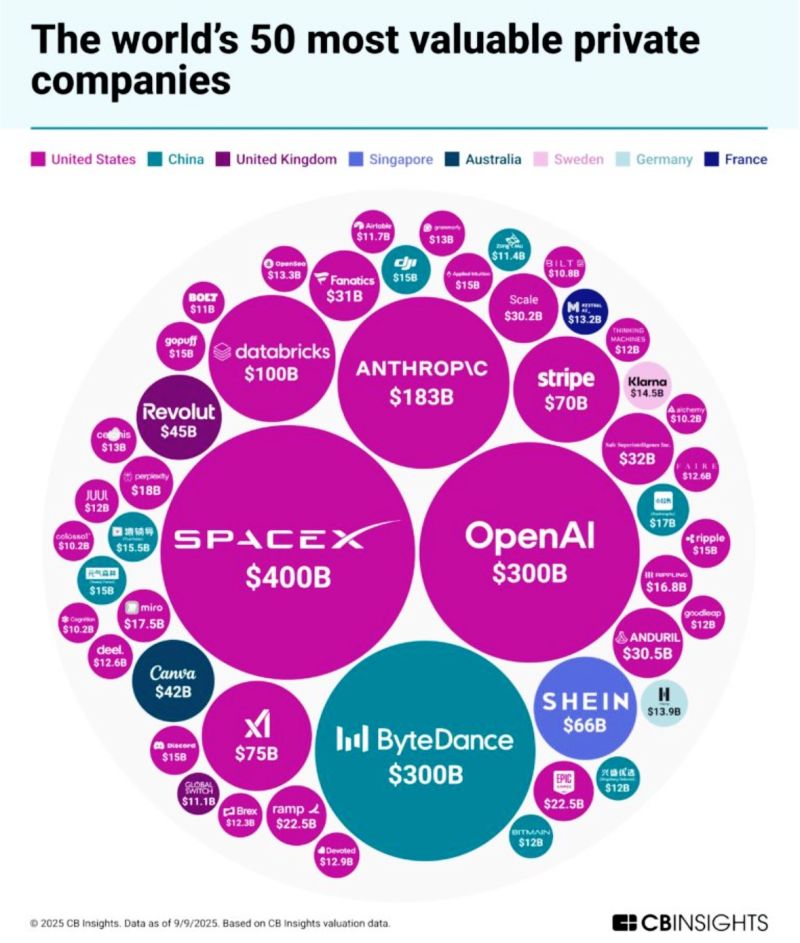

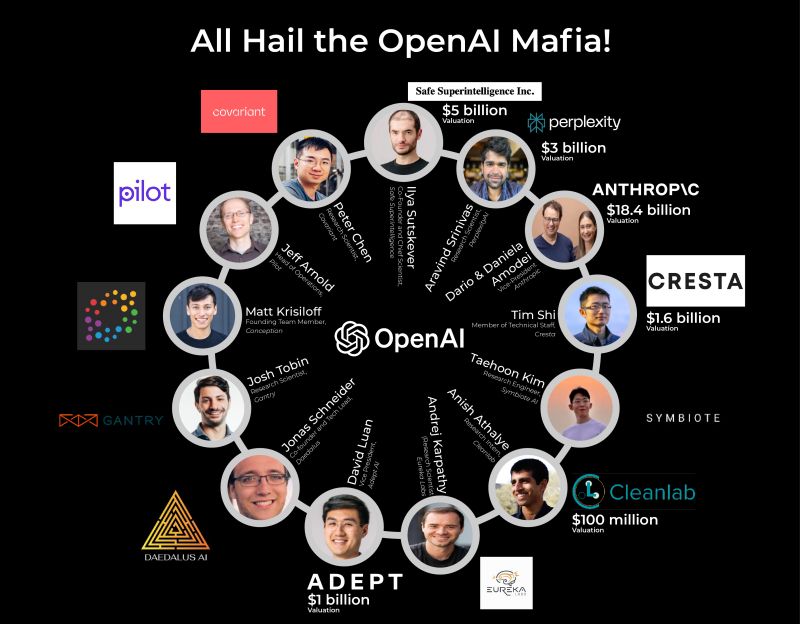

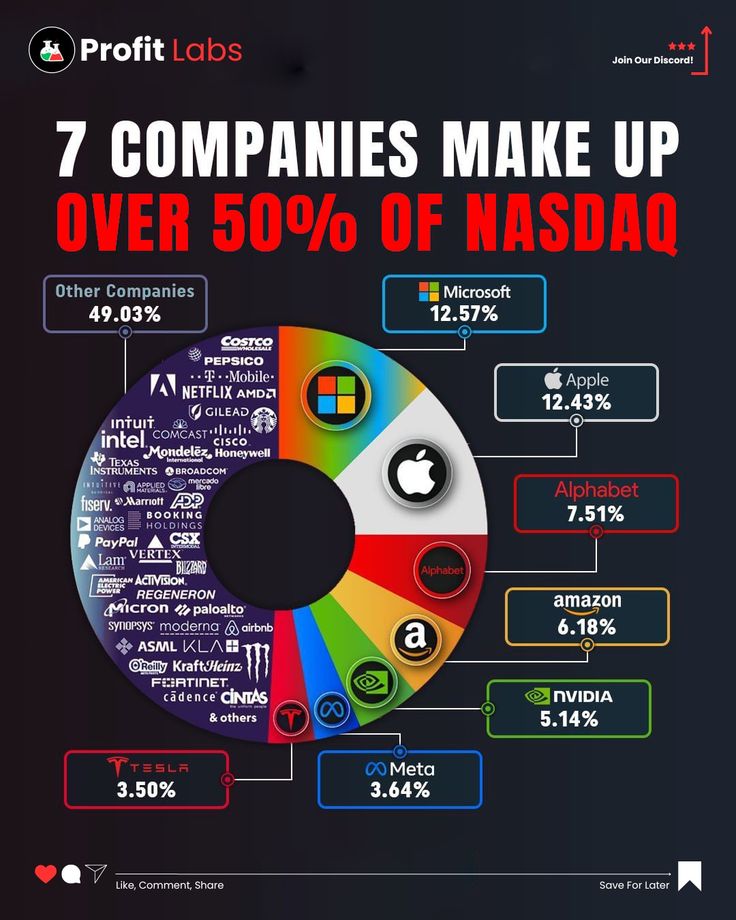

XAI100 is strategically positioned as an exchange-listed investment vehicle targeting the Top 100 High-Growth AI Companies, structured as a closed-end fund registered under the Investment Company Act of 1940. This innovative fund aims to democratize access for individual investors to high-growth private AI leaders by aggregating equity exposures to pre-IPO and post-IPO private market darlings.

Structural Overview

This structure combines the growth potential of frontier AI technologies with the capital efficiency of closed-end fund architecture, creating a novel asset class for institutional and retail investors alike.

Operational Framework

As a Regulation D-compliant closed-end fund, XAI100 will employ a dual-layer investment strategy:

- Primary Market Access: Strategic allocations to pre-IPO AI startups through convertible preferred stock and SAFE agreements

- Secondary Market Liquidity: Select acquisitions of publicly traded AI equities with superior growth trajectories

Eligibility Criteria

Portfolio companies must demonstrate:

- Minimum $50M ARR with >300% YoY growth

- Institutional validation through Series B+ funding rounds from Tier-1 VCs (e.g., Sequoia, a16z)

- Scalable AI infrastructure with >$1B TAM

- Compliance with US/EU data sovereignty regulations

Market Execution

The common shares will list on the NYSE under the ticker XAI or NASDAQ under XAI, subject to final underwriter determination. Initial liquidity provisions include:

- 15% authorized share over-allotment option

- Dual-bookrunner structure (Goldman Sachs/J.P. Morgan)

- 30-day price stabilization period

Mission, Vision and Core Values

• Mission: To bridge the gap between groundbreaking AI innovation and individual capital by backing the next generation of category-defining companies—at scale.

• Vision: To be the most trusted partner for investing in pre-IPO AI leaders, delivering outsized returns while shaping the future of technology.

• Core Values:

◦ Discipline: Rigorous 100-company shortlist (based on tech moats, market cap potential, ESG).

◦ Transparency: Real-time portfolio updates (post-NASDAQ listing).

◦ Long-Term Vision: Holding periods aligned with AI company scaling cycles (5–7 years).

Empowering Investors with Premier AI Ventures

Explore our exclusive fund offerings, highlighting a curated portfolio of 100 leading private AI innovators driving tomorrow’s technology.

AI Startup Spotlight

Venture Growth Fund

Innovative AI Leaders

Investment Categories

Blog

Explore expert analysis and updates on private AI investments, market trends, and innovations shaping the future of technology.

-

The Future of AI: How XAI100 is Leading the Way

This paragraph serves as an introduction to your blog post. Begin by…

-

Exploring the Impact of AI on Investment Strategies

This paragraph serves as an introduction to your blog post. Begin by…

-

How to Access High-growth AI Companies as an Individual Investor

This paragraph serves as an introduction to your blog post. Begin by…

Invest in the Future of AI Innovation

Discover upcoming investment opportunities and insights to connect with leading AI ventures and our investor community.

AI Growth Summit 2026: Shaping Tomorrow

Aug 23, 2026

Exclusive Investor Webinar: AI Market Insights

Oct 14, 2026

Portfolio Review & Innovation Panel

Dec 07, 2026

Unlocking Growth with Exclusive AI Investment Opportunities

ADD: 30 Wall Street 8th Floor, New York, NY, 10005, USA

Phone: (646) 453-5290

Email: info@xaifund.io